The Indian government recently made gold and silver imports cheaper by reducing their base import prices (notional value for duty calculation) in early February 2026, easing the customs duty burden, even as overall duty rates remained around 6-5%. This makes importing bullion less costly for traders, though it doesn’t immediately guarantee lower retail prices, it helps manage high global costs and could soften future price increases. Gold and Silver Imports Get Cheaper After Government Cuts Base Prices India cuts gold and silver base import prices, reducing customs duty burden as global prices remain high.

The Government of India has reduced the base import prices of gold and silver, lowering the notional value used to calculate customs duties. The revision was notified on February 4, 2026, by the Central Board of Indirect Taxes and Customs.

Revised Base Import Prices for Gold and Silver

The base import price of gold has been reduced by around $50 to $1,518 per 10 grams. The base price of silver has been lowered by more than $800 to $2,657 per kilogram.

These revised prices apply to gold and silver imported in specified forms under applicable tariff headings. The reduction also covers high purity gold bars and coins, along with silver bullion and medallions.

Scope and Exclusions Under the Revision

The revised base prices do not apply to jewellery, articles made of precious metals, or imports made through post, courier, or baggage channels. The changes affect only the calculation base for customs duty and not the applicable duty rates.

Gold base prices were last revised on January 22, 2026, while silver base prices were previously revised on January 27, 2026.

Impact on Imports and Trade Metrics

The reduction comes at a time when global gold and are near record levels. Even if import volumes remain unchanged, the value of imports may rise due to elevated international prices.

India meets nearly all of its gold demand through imports and depends on overseas sources for more than 80% of its silver requirements. The country spent close to 10% of its total foreign exchange reserves on gold and silver imports in the previous year.

Government Review Mechanism

The government typically reviews and revises base import prices of precious metals every 2 weeks, aligning domestic duty calculations with global price movements.

Conclusion

The reduction in base import prices for gold and silver adjusts the customs duty calculation amid high global prices. The move reflects routine revisions under India’s import pricing mechanism for precious metals.

Disclaimer: This blog has been written exclusively for educational purposes. The securities or companies mentioned are only examples and not recommendations. This does not constitute a personal recommendation or investment advice. It does not aim to influence any individual or entity to make investment decisions. Recipients should conduct their own research and assessments to form an independent opinion about investment decisions.

Investments in the securities market are subject to market risks, read all the related documents carefully before investing.

Key Actions by the Government (Early February 2026):

- Reduced Base Prices: The Central Board of Indirect Taxes and Customs (CBIC) cut the official base prices for gold and silver.

- Specific Cuts: Gold’s base price dropped by about $50 per 10 grams, and silver by over $800 per kilogram.

- Impact: Importers pay less tax on the official lower value, reducing overall import costs.

The base import price of gold has been cut by about $50 to $1,518 per 10 grams, while that of silver has been reduced by over $800 to $2,657 per kilogram. The revised prices apply to gold and silver imported in any form under specified tariff headings.

The duty reduction also covers high-purity gold bars and coins, and silver bullion and medallions, but exclude jewellery, articles made of precious metals and imports through post, courier or baggage.

The government typically revises base import prices of precious metals every fortnight.

With gold and silver prices touching record highs, the value of imports is estimated to rise sharply even if volumes remain unchanged, stoking concerns over a widening trade deficit and further putting pressure on the rupee, which has already weakened significantly against the dollar in recent times.

The import reduction comes at a time when trade and industry officials were cautious on the imports and had flagged that these risks could prompt the government to consider raising import duties on gold and silver in the coming weeks. India is the world’s second-largest consumer of gold and the largest market for silver, but it meets nearly all of its gold demand through imports and depends on overseas supplies for over 80% of its silver requirements.

The country spent close to a tenth of its total foreign exchange reserves on gold and silver imports last year, and the import bill is expected to rise further in 2026 as prices of both metals continue to surge.

The Gold Collar Life arrives in BKC: Raymond Realty brings a new ultra-luxury benchmark to Mumbai Raymond Realty is launching ‘The Gold Collar Life’ in Bandra Kurla Complex. This new ultra-luxury residential project targets successful individuals who have earned their wealth. The development emphasizes strategy, precision, and privacy. Raymond Realty is also planning a significant luxury project in Wadala. This expansion highlights the company’s focus on prime Mumbai locations.

Luxury is no longer determined by inheritance; it is defined by accomplishment. Mumbai’s high-end residential landscape is experiencing a fundamental shift. The modern luxury consumer is not someone born into privilege, but someone who has earned it. These are leaders, founders, wealth creators, innovators and decision-makers, individuals who value quiet confidence over ostentation, rare experiences over excess and enduring quality over fleeting trends.

For this refined audience, a home is more than a lifestyle choice. It is a personal statement; a reflection of perseverance, intellect and milestones that shaped their journey. Their address must echo the same principles that led them to success: strategy, precision, privacy, and proximity to influence. This announcement marks the brand’s next ultra-luxury residential venture in Mumbai’s most influential district, and a defining milestone in its luxury portfolio, the most strategically significant launch to date.

The Gold Collar Life aligns seamlessly with an audience that values power, precision, institutional prestige, and global connectivity. BKC offers unmatched advantages: proximity to Fortune 500 companies, international consulates, and world-class lifestyle destinations, such as Jio World Drive and Jio World Plaza, supported by transformative infrastructure, including the upcoming Bullet Train Terminal, Metro Line 3, and the Coastal Road network. With residences still priced nearly 30% below Bandra West, the district offers a rare pre-convergence opportunity, further elevated by the upcoming Bombay High Court complex, which brings long-term institutional and social permanence. For those shaping India’s economic future, BKC is not just an address; it is Mumbai’s most powerfulresidential identity.

Raymond Realty’s ultra-luxury philosophy represents the highest expression of design intelligence, precision planning and lifestyle innovation. Conceived through the personal design principles of Chairman and Managing Director Gautam Singhania, the category is founded on a definitive belief: true luxury is earned, not inherited.

Expanding the footprint: Wadala, the next address

As Raymond Realty prepares to introduce The Gold Collar Life to BKC with its upcoming ultra-luxury residential development, the brand is concurrently gearing up for its next strategic expansion: a landmark luxury development in Wadala. Poised to become Mumbai’s third Central Business District (CBD), Wadala is being reshaped by major infrastructure investments, including Metro Lines 4 & 11, the Mumbai Trans Harbour Link, and the Eastern Freeway. The micro-market is rapidly emerging as a hub of connectivity, investment and long-term appreciation.

More details will be announced soon, as Raymond Realty continues its purposeful luxury expansion across Mumbai’s most coveted micro-markets.

Why This Matters:

- Major Importer: India imports most of its gold and significant silver, so import costs heavily influence domestic prices.

- High Global Prices: This move helps offset record-high global precious metal prices.

- Not a Duty Rate Cut: While a duty cut to 5% was announced in Budget 2026 (from 6%), this specific action in February was a revision of the base price, lowering the taxable value.

Gold Silver Market Shakeup: Understanding the Post-Budget Crash for Investors and Merchants Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman tabled the Union Budget 2026-27 in the parliament today. The highlights of the budget are as follows:

The first Budget prepared in Kartavya Bhawan, is inspired by 3 kartavyas:

- First kartavya is to accelerate and sustain economic growth, by enhancing productivity and competitiveness, and building resilience to volatile global dynamics.

- Second kartavya is to fulfil aspirations of people and build their capacity, making them strong partners in India’s path to prosperity

- Third kartavya, aligned with vision of Sabka Sath, Sabka Vikas, is to ensure that every family, community, region and sector has access to resources, amenities and opportunities for meaningful participation.

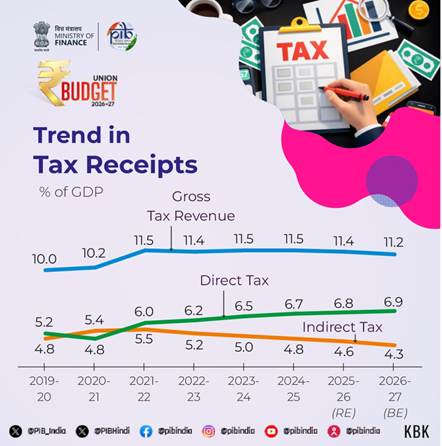

Budget Estimates

- The non-debt receipts and the total expenditure are estimated as ₹36.5 lakh crore and ₹53.5 lakh crore respectively. The Centre’s net tax receipts are estimated at ₹28.7 lakh crore.

- The gross market borrowings are estimated at ₹17.2 lakh crore and the net market borrowings from dated securities are estimated at ₹11.7 lakh crore.

- The Revised Estimates of the non-debt receipts are ₹34 lakh crore of which the Centre’s net tax receipts are ₹26.7 lakh crore.

- The Revised Estimate of the total expenditure is ₹49.6 lakh crore, of which the capital expenditure is about ₹11 lakh crore.

- The fiscal deficit in BE 2026-27 is estimated to be 4.3 percent of GDP.

- In RE 2025-26, the fiscal deficit has been estimated at par with BE of 2025-26 at 4.4 percent of GDP.

- The debt-to-GDP ratio is estimated to be 55.6 percent of GDP in BE 2026-27, compared to 56.1 percent of GDP in RE 2025-26.

First Kartavya is to accelerate and sustain economic growth and proposes 6 interventions

1. Scaling up manufacturing in 7 strategic and frontier sectors

- Biopharma SHAKTI (Strategy for Healthcare Advancement through Knowledge, Technology and Innovation) announced, with an outlay of ₹ 10,000 crores over the next 5 years to develop India as a global Biopharma manufacturing hub.

- A Biopharma-focused network to be created with 3 new National Institutes of Pharmaceutical Education and Research (NIPER) and upgrading 7 existing ones.

- A network of over 1000 accredited India Clinical Trials sites to be created

- India Semiconductor Mission (ISM) 2.0 to be launched to produce equipment and materials, design full-stack Indian IP, and fortify supply chains with focus on industry led research and training centres to develop technology and skilled workforce.

- The Electronics Components Manufacturing Scheme outlay increased to ₹40,000 crore.

- Dedicated Rare Earth Corridors to be established, to support the mineral-rich States of Odisha, Kerala, Andhra Pradesh and Tamil Nadu to promote mining, processing, research and manufacturing.

- Government to launch a Scheme to support States in establishing 3 dedicated Chemical Parks, through challenge route, on a cluster-based plug-and-play model.

- Strengthening Capital Goods Capability

- Hi-Tech Tool Rooms to be established by CPSEs at 2 locations as digitally enabled automated service bureaus that locally design, test, and manufacture high-precision components at scale and at lower cost.

- A Scheme for Enhancement of Construction and Infrastructure Equipment (CIE) to be introduced, to strengthen domestic manufacturing of high-value and technologically-advanced CIE.

- A Scheme for Container Manufacturing announced, to create a globally competitive container manufacturing ecosystem, with a budgetary allocation of over ₹10,000 crore over a 5 year period.

- Integrated Programme for the Textile Sector announced

- The National Fibre Scheme for self-reliance in natural fibres such as silk, wool and jute, man-made fibres, and new-age fibres.

- Textile Expansion and Employment Scheme to modernize traditional clusters with capital support for machinery, technology upgradation and common testing and certification centres.

- Mega Textile Parks to be setup in challenge mode with focus on bringing value addition to technical textiles.

- Mahatma Gandhi Gram Swaraj initiative announced, to strengthen khadi, handloom and handicrafts.

- Initiative to help in global market linkage, branding and will streamline and support training, skilling, quality of process and production.

2. Rejuvenating legacy industrial sectors

- A Scheme to revive 200 legacy industrial clusters announced, to improve their cost competitiveness and efficiency through infrastructure and technology upgradation.

3. Creating “Champion SMEs” and supporting micro enterprises

- A dedicated ₹10,000 crore SME Growth Fund, to be introduced, to create future Champions, incentivizing enterprises based on select criteria.

- Self-Reliant India Fund to be allocated with additional ₹2,000 crore, to continue support to micro enterprises and maintain their access to risk capital.

- Government to facilitate Professional Institutions such as ICAI, ICSI, ICMAI to design short-term, modular courses and practical tools to develop a cadre of ‘Corporate Mitras’, especially in Tier-II and Tier-III towns.

4. Delivering a powerful push to Infrastructure

- Public capital expenditure to be increased to ₹12.2 lakh crore in FY 2026-27.

- Government to set up an Infrastructure Risk Guarantee Fund to strengthen the confidence of private developers regarding risks during infrastructure development and construction phase.

- Government to accelerate recycling of significant real estate assets of CPSEs through the setting up of dedicated REITs.

- To promote environmentally sustainable movement of cargo, following measures are proposed:

- New Dedicated Freight Corridors to be established connecting Dankuni in the East, to Surat in the West

- 20 new National Waterways (NW) to be operationalised over next 5 years, starting with NW-5 in Odisha to connect mineral rich areas of Talcher and Angul and industrial centres like Kalinga Nagar to the Ports of Paradeep and Dhamra.

- Training Institutes to be set up as Regional Centres of Excellence for development of the required manpower.

- Further, a ship repair ecosystem catering to inland waterways to be set up at Varanasi and Patna

- A Coastal Cargo Promotion Scheme to be launched for incentivising a modal shift from rail and road, to increase the share of inland waterways and coastal shipping from 6% to 12 % by 2047.

- Incentives to be provided to indigenize manufacturing of seaplanes and enhance last-mile and remote connectivity, and promote tourism.

- Seaplane VGF Scheme to be introduced to provide support for operations.

5. Ensuring long term energy security and stability

- An outlay of ₹20,000 crore over the next 5 years, announced for Carbon Capture Utilization and Storage (CCUS) technologies.

6. Developing City Economic Regions

- An allocation of ₹5000 crore over 5 years, per city economic regions (CER) announced, for implementing their plans through a challenge mode with a reform-cum-results based financing mechanism.

- Government to develop Seven High-Speed Rail corridors between cities as ‘growth connectors’ to promote environmentally sustainable passenger systems. These include:

- Mumbai-Pune

- Pune-Hyderabad,

- Hyderabad-Bengaluru,

- Hyderabad-Chennai

- Chennai-Bengaluru,

- Delhi-Varanasi,

- Varanasi-Siliguri.

- Government to setup a “High Level Committee on Banking for Viksit Bharat”, to comprehensively review the sector and align it with India’s next phase of growth, while safeguarding financial stability, inclusion and consumer protection.

- Government to restructure the Power Finance Corporation and Rural Electrification Corporation to achieve scale and improve efficiency in the Public Sector NBFCs.

- A comprehensive review of the Foreign Exchange Management (Non-debt Instruments) Rules is proposed, to create a more contemporary, user-friendly framework for foreign investments, consistent with India’s evolving economic priorities.

Municipal Bonds

- An incentive of ₹100 crore for a single bond issuance of more than ₹1000 crore announced, to encourage the issuance of municipal bonds of higher value by large cities.

Second Kartavya is to fulfil aspirations and build capacity of people

- Government to set up a High-Powered ‘Education to Employment and Enterprise’ Standing Committee to recommend measures that focus on the Services Sector as a core driver of Viksit Bharat.

Creation of Professionals for Viksit Bharat

- Existing institutions for Allied Health Professionals (AHPs) to be upgraded and new AHP Institutions to be established in private and Government sectors

- 100,000 Allied Health Professionals to be added over the next 5 years

- Five Regional Medical Hubs to be established, to promote India as a hub for medical tourism services.

AYUSH

- 3 new All India Institutes of Ayurveda to be established

.

Animal Husbandry

- Government to scale up availability of veterinary professionals by more than 20,000

- A loan-linked capital subsidy support scheme to be launched for establishment of veterinary and para vet colleges, veterinary hospitals, diagnostic laboratories and breeding facilities in the private sector.

Orange Economy

- Indian Institute of Creative Technologies, Mumbai to be provided support in setting up , Visual Effects, Gaming and Comics (AVGC) Content Creator Labs in 15,000 secondary schools and 500 colleges.

Education

- 5 University Townships to be created in the vicinity of major industrial and logistic corridors through challenge route.

- Through VGF/capital support, 1 girls’ hostel to be established in every district

Tourism

- National Council for Hotel Management and Catering Technology to be upgraded to National Institute of Hospitality

- A pilot scheme for upskilling 10,000 guides in 20 tourist sites announced through a standardized, high-quality 12-week training course in hybrid mode In collaboration with an IIM.

- A National Destination Digital Knowledge Grid to be established to digitally document all places of significance—cultural, spiritual andheritage.

Heritage and Culture Tourism

- 15 archeological sites including Lothal, Dholavira, Rakhigarhi, Adichanallur, Sarnath, Hastinapur, and Leh Palace to be developed into vibrant, experiential cultural destinations

Sports

- Khelo India Mission to be launched to transform the Sports sector over the next decade.

Third Kartavya is aligned with vision of Sabka Sath, Sabka Vikas and requires targeted efforts in the following four areas:

1. Increasing Farmer Incomes

- New Initiatives to be undertaken for

- Integrated development of 500 reservoirs and Amrit Sarovars

High Value Agriculture:

- Govt. to support high value crops such as :

- coconut, sandalwood, cocoa and cashew in coastal areas

- Coconut Promotion Scheme to be launched to increase production and enhance productivity.

Bharat-VISTAAR (Virtually Integrated System to Access Agricultural Resources)

- Government to launch Bharat-VISTAAR, a multilingual AI tool to integrate the AgriStack portals and the ICAR package on agricultural practices with AI systems.

2. Empowering Divyangjan

- Divyangjan Kaushal Yojana for Divyangjans to offer task-oriented and process-driven roles in IT, AVGC sectors, Hospitality and Food and Beverages sectors.

3. Commitment to Mental Health and Trauma Care

- Government to set up NIMHANS-2 in north India.

- Government to upgrade National Mental Health Institutes in Ranchi and Tezpur as Regional Apex Institutions.

4. Focus on the Purvodaya States and the North-Eastern Region

- Government to develop an integrated East Coast Industrial Corridor with a well-connected node at Durgapur, creation of 5 tourism destinations in the 5 Purvodaya States, and the provision of 4,000 e-buses.

- A scheme to be launched for the development of Buddhist Circuits in Arunachal Pradesh, Sikkim, Assam, Manipur, Mizoram and Tripura.

16th Finance Commission

- Government provided ₹1.4 lakh crore to the States for the FY 2026-27 as Finance Commission Grants as recommended by the 16th Finance Commission.

PART –B

Direct Taxes

New Income Tax Act

· New Income tax Act ,2025 to come into effect from April 2026

· The simplified Income Tax Rules and Forms will be notified shortly. The forms redesigned for easy compliance of ordinary citizens.

Ease of Living

- Interest awarded by the Motor Accident Claims Tribunal to a natural person will be exempt from Income Tax, and any TDS on this account will be done away with.

- TCS Rationalization

- Reduce TCS rate on sale of overseas tour program package to 2 % (from current 2-20%).

- Reduce the TCS rate to 2% (from current 5%) for LRS remittances for education and medical.

- Simplified TDS provisions for manpower supply will benefit labour intensive business.

- Scheme for small taxpayers wherein a rule based automated process for obtaining Lower or nil deduction certificate instead of filing application with the assessor.

- Single window filing with depositories for Form 15G or 15 H for TDS on dividends, interests etc

- Extend time available for revising returns from 31st December to upto 31st March with payment of nominal fees

- The timeline for filing of tax returns to be staggered .

- TAN for property transactions involving NRIs will be replaced with resident buyers PAN based challan.

- A one time 6 month foreign asset disclosure scheme for small taxpayers to disclose their overseas income or asset.

Rationalizing Penalty and Prosecution

- IT assessment & penalty proceedings are proposed to be integrated by way of common order for both.

- Taxpayers allowed to update their returns even after reassessment proceedings have been initiated to reduce litigations, at an additional 10 percent tax rate over and above the rate applicable for the relevant year.

- Penalty for misreporting of income also eligible for immunity with payment of additional income tax.

- Prosecution framework under the Income Tax Act to be rationalized.

- Non-production of books of account and documents, and requirement of TDS payment, where payment is made in kind, to be decriminalised.

- Non-disclosure of non-immovable foreign assets with aggregate value less than 20 lakh rupees to be provided with immunity from prosecution with retrospective effect from 1.10.2024.

Cooperatives

- Extend deduction already allowed to a primary cooperative society engaged in supplying milk, oilseeds, fruits or vegetables raised or grown by its members to those supplying cattle feed and cotton seed also.

- Allow the inter-cooperative society dividend income as deduction under the new tax regime to the extent it is further distributed to its members.

- Exemption for a period of 3 years allowed to dividend income received by a notified national cooperative federation, on their investments made in companies up to 31.1.2026, for dividends further distributed to its member co-operatives.

Supporting IT sector as India’s growth engine

- Software development services, IT enabled services, knowledge process outsourcing services and contract R&D services relating to software development to be clubbed under a single category of Information Technology Services with a common safe harbour margin of 15.5 percent.

- The threshold for availing safe harbour for IT services to be enhanced from 300 crore rupees to 2,000 crore rupees.

- Safe harbour for IT services shall be approved by an automated rule-driven process, can be continued for a period of 5 years at a stretch.

- Unilateral Advanced Pricing Agreement (APA) process for IT services to be fast-tracked with the endeavour to conclude it within a period of 2 years, which can be extended by 6 months on taxpayer’s request.

- The facility of modified returns available to the entity entering APA to be extended to its associated entities.

Attracting global business and investment

- Any foreign company that provides cloud services to customers globally by using data centre services from India to be provided Tax holiday till 2047

- A safe harbour of 15 percent on cost to be provided if the company providing data centre services from India is a related entity.

- A safe harbour to non-residents for component warehousing in a bonded warehouse at a profit margin of 2 percent of the invoice value. The resultant tax of about 0.7 percent will be much lower than in competing jurisdictions.

- Exemption from income tax for 5 years to be provided to any non-resident who provides capital goods, equipment or tooling, to any toll manufacturer in a bonded zone.

- Exemption to global (non-India sourced) income of a non-resident expert, for a stay period of 5 years under notified schemes

- Exemption from Minimum Alternate Tax (MAT) to all non-residents who pay tax on presumptive basis.

Tax administration

- A Joint Committee of Ministry of Corporate Affairs and Central Board of Direct Taxes to be constituted for incorporating the requirements of Income Computation and Disclosure Standards (ICDS) in the Indian Accounting Standards (IndAS) itself. Separate accounting requirement based on ICDS will be done away with from the tax year 2027-28.

- Definition of accountant for the purposes of Safe Harbour Rules to be rationalized.

Other Tax proposals

- In the interest of minority shareholders, buyback for all types of shareholders to be taxed as Capital Gains. Promoters to pay an additional buyback tax, making effective tax 22 percent for corporate promoters and 30 percent for non-corporate promoters.

- TCS rate for sellers of specific goods namely alcoholic liquor, scrap and minerals will be rationalized to 2 percent and that on tendu leaves will be reduced from 5 percent to 2 percent.

- STT on Futures to be raised to 0.05 percent from present 0.02 percent. STT on options premium and exercise of options to be raised to 0.15 percent from the present rate of 0.1 percent and 0.125 percent respectively.

- To encourage companies to shift to the new regime, set-off of brought forward MAT credit to be allowed to companies only in the new regime. Set-off using available MAT credit to be allowed to an extent of 1/4th of the tax liability in the new regime.

- MAT is proposed to be made final tax. There will be no further credit accumulation from 1st April 2026. The rate of final tax to be reduced to 14 percent from the current MAT rate of 15 percent. The brought forward MAT credit of taxpayers accumulated till 31st March 2026, will continue to be available to them for set-off as above.

Indirect taxes:

Tariff Simplification

Marine, leather, and textile products:

- The limit for duty-free imports of specified inputs used for processing seafood products for export, to increase from the current 1 per cent to 3 per cent of the FOB value.

- The duty-free imports of specified inputs, which is currently available for exports of leather or synthetic footwear to be allowed.

Energy transition and security:

- The basic customs duty exemption given to capital goods used for manufacturing Lithium-Ion Cells for batteries to be extended.

- The basic customs duty on import of sodium antimonate for use in manufacture of solar glass to be exempted.

Nuclear Power:

- The existing basic customs duty exemption on imports of goods required for Nuclear Power Projects to be extended till the year 2035.

Critical Minerals:

- The basic customs duty to the import of capital goods required for processing of critical minerals to be exempted.

Biogas blended CNG:

- The entire value of biogas while calculating the Central Excise duty payable on biogas blended CNG to be excluded.

Civil and Defence Aviation:

- The basic customs duty on components and parts required for the manufacture of civilian, training and other aircrafts to be exempted.

- The basic custom duty on raw materials imported for manufacture of parts of aircraft to be used in maintenance, repair, or overhaul requirements by Units in the Defence sector to be exempted.

Electronics:

- The basic customs duty on specified parts used in the manufacture of microwave ovens to be exempted.

Special Economic Zone:

- A special one-time measure, to facilitate sales by eligible manufacturing units in SEZs to the Domestic Tariff Area (DTA) at concessional rates of duty is proposed. The quantity of such sales will be limited to a prescribed proportion of their exports.

Ease of Living:

- The tariff rate on all dutiable goods imported for personal use to be reduced from 20 per cent to 10 per cent.

- The basic customs duty on 17 drugs/ medicines is to be exempted.

- Duty free personal import of drugs/ medicines and food for 7 more rare diseases.

Customs Process simplification

- Custom processes to have minimal intervention for smoother and faster movement of goods.

Trust-based systems

- Duty deferral period for Tier 2 and Tier 3 Authorised Economic Operators, known as AEOs, to be enhanced from 15 days to 30 days. Same is extended to the eligible manufacturer-importers

- Validity period of advance ruling, binding on Customs, to be extended from the present 3 years to 5 years.

- Government agencies will be encouraged to leverage AEO accreditation for preferential treatment in clearing their cargo.

- Filing of bill of entry by a trusted importer, and arrival of goods will automatically notify Customs for completing their clearance formalities (for import of goods not needing any compliance).

- The Customs warehousing framework to be transformed into a warehouse operator-centric system with self-declarations, electronic tracking and risk-based audit.

Ease of Doing Business

- Cargo clearance approvals from various Government agencies to be seamlessly processed through a single and interconnected digital window by the end of the financial year.

- Processes involved in clearance of food, drugs, plant, animal & wild life products, accounting for around 70 percent of interdicted cargo, to be operationalised on this system by April 2026 itself.

- For goods not having any compliance requirement, clearance to be done by Customs immediately after online registration is completed by the importer.

- Customs Integrated System (CIS) to be rolled out in 2 years as a single, integrated and scalable platform for all the customs processes.

- Utilization of non-intrusive scanning with advanced imaging and AI technology for risk assessment to be expanded in a phased manner with the objective to scan every container across all the major ports.

New export opportunities

- Fish catch by an Indian fishing vessel in Exclusive Economic Zone (EEZ) or on the High Seas to be made free of duty, Landing of such fish on foreign port will be treated as export of goods.

- Complete removal of the current value cap of ₹10 lakh per consignment on courier exports-supports aspirations of India’s small businesses, artisans and start-ups to access global markets through e-commerce

Ease of Living

· Provisions governing baggage clearance to be revised during international travel. Revised rules to enhance duty-free allowances in line with the present day travel realities.

· Honest taxpayers, willing to settle disputes will be able close cases by paying an additional amount in lieu of penalty.

For merchants, jewelers, and founders using gold as a hedge, the recent volatility has been a whirlwind, with prices plunging from record highs to hit lower circuits on the Multi-Commodity Exchange (MCX). While the budget introduced a welcome cut in import duties, a significant “curveball” regarding the taxation of Sovereign Gold Bonds (SGBs) has reshaped the investment landscape overnight.

At a Glance: Key Gold & Silver Highlights

- Customs Duty Cut: The government has reduced the import duty on gold and silver to 5% (down from 6%), a move aimed at lowering base costs and discouraging smuggling.

- The MCX Meltdown: Gold futures hit lower circuits during the budget session, at one point sliding to nearly ₹1.36 lakh per 10 grams before a partial recovery.

- Silver’s Free Fall: Silver experienced its worst-ever crash, plunging nearly 27% in a single session and hitting lower circuits at approximately ₹2.65 lakh per kg.

- SGB Tax Tweak: Capital gains tax exemptions for Sovereign Gold Bonds are now restricted only to original subscribers who hold the bond until maturity. Secondary market buyers will no longer enjoy tax-free redemptions.

- Global Pressure: A strengthening US Dollar and the nomination of Kevin Warsh as the next US Fed Chair, viewed by many as a policy hawk, added immense downward pressure on global bullion prices.

Gold Rate Today: Where Prices Stand (Feb 3, 2026)

The post-budget dust is starting to settle, but the “cooling off” hasn’t quite stopped. As of February 3, prices have dipped a bit further from yesterday’s levels, staying well below those crazy peaks we saw in January.

| Gold Purity | Rate per Gram (Avg) | Rate per 10 Grams (Avg) |

| 24K Gold | ₹15,175 | ₹1,51,750 |

| 22K Gold | ₹13,910 | ₹1,39,100 |

| 18K Gold | ₹11,381 | ₹1,13,810 |

Note: Prices may vary slightly by city due to local taxes and making charges.

The Numbers at a Glance

The correction was swift and clinical. Within 48 hours of the Budget announcement, the Multi-Commodity Exchange (MCX) saw prices hit lower circuits, a rare event for precious metals.

| Asset | Pre-Budget Peak (Jan ’26) | Post-Budget Low (Feb ’26) | % Correction |

| Gold (24K/10g) | ~₹1,93,000 | ~₹1,51,000 | ~22% |

| Silver (per kg) | ~₹4,20,000 | ~₹2,85,000 | ~32% |

Making Sense of the Sudden Price Drop

Market analysts have described the recent correction as a necessary cooling-off period after a “parabolic rally.” Several factors converged to trigger this crash:

- Profit Booking: Investors who rode the wave to record highs in January aggressively “cashed out” on budget day, leading to a massive sell-off.

- Import Duty Expectations: While the 1% cut was positive, many in the bullion industry were bracing for even steeper duty hikes or different GST rationalizations, leading to a “sell-on-news” reaction when those did not materialize.

- Margin Hikes: Global and domestic exchanges (like CME and MCX) raised margin requirements for gold and silver, forcing many traders to liquidate their positions to cover costs.

- The “Warsh” Effect: The nomination of Kevin Warsh to lead the US Fed signaled to the markets that US interest rates might stay higher for longer, which typically makes non-yielding assets like gold less attractive.

What’s Actually Going on With SGBs

1. What is Sovereign Gold Bond (SGB)? Who is the issuer?

SGBs are government securities denominated in grams of gold. They are substitutes for holding physical gold. Investors have to pay the issue price in cash and the bonds will be redeemed in cash on maturity. The Bond is issued by Reserve Bank on behalf of Government of India.

2. Why should I buy SGB rather than physical gold? What are the benefits?

The quantity of gold for which the investor pays is protected, since he receives the ongoing market price at the time of redemption/ premature redemption. The SGB offers a superior alternative to holding gold in physical form. The risks and costs of storage are eliminated. Investors are assured of the market value of gold at the time of maturity and periodical interest. SGB is free from issues like making charges and purity in the case of gold in jewellery form. The bonds are held in the books of the RBI or in demat form eliminating risk of loss of scrip etc.

3. Are there any risks in investing in SGBs?

There may be a risk of capital loss if the market price of gold declines. However, the investor does not lose in terms of the units of gold which he has paid for.

4. Who is eligible to invest in the SGBs?

Persons resident in India as defined under Foreign Exchange Management Act, 1999 are eligible to invest in SGB. Eligible investors include individuals, HUFs, trusts, universities and charitable institutions. Individual investors with subsequent change in residential status from resident to non-resident may continue to hold SGB till early redemption/maturity.

5. Whether joint holding will be allowed?

Yes, joint holding is allowed.

6. Can a Minor invest in SGB?

Yes. The application on behalf of the minor has to be made by his/her guardian.

7. Where can investors get the application form?

It can also be downloaded from the RBI’s website. Banks may also provide online application facility.

8. What are the Know-Your-Customer (KYC) norms?

Every application must be accompanied by the ‘PAN Number’ issued by the Income Tax Department to the investor(s).

9. Can an investor hold more than one investor ID for subscribing to the Sovereign Gold Bond?

No. An investor can have only one unique investor Id linked to any of the prescribed identification documents. The unique investor ID is to be used for all the subsequent investments in the scheme. For holding securities in dematerialized form, quoting of PAN in the application form is mandatory.

10. What is the minimum and maximum limit for investment?

The Bonds are issued in denominations of one gram of gold and in multiples thereof. Minimum investment in the Bond shall be one gram with a maximum limit of subscription of 4 kg for individuals, 4 kg for Hindu Undivided Family (HUF) and 20 kg for trusts and similar entities notified by the government from time to time per fiscal year (April – March). In case of joint holding, the limit applies to the first applicant. The annual ceiling will include bonds subscribed under different tranches during initial issuance by Government and those purchased from the secondary market. The ceiling on investment will not include the holdings as collateral by banks and other Financial Institutions

Previously, anyone holding an SGB until maturity enjoyed tax-free capital gains, even if they bought the bond from the stock market (secondary market). Under the new rules, this tax exemption is only available to the original subscriber who bought the bond directly from the RBI and held it continuously until maturity. If you buy SGBs on an exchange now, you will be liable for a 12.5% Long-Term Capital Gains (LTCG) tax upon redemption.

The Big Question is, is now a Good Time to buy?

Despite the “scary” look of lower circuits on trading screens, many experts believe the long-term story for gold remains intact. The 5% import duty cut helps reduce the entry price for genuine buyers and jewelers.

For merchants and retail buyers, the current dip of over 10% to 20% from record highs is being viewed as a “staggered buying” opportunity rather than a reason to panic. However, the shift in SGB taxation means that investors should now focus more on primary RBI issuances or look at Digital Gold and Gold ETFs, where the tax rules remain more predictable.

Frequently Asked Questions (FAQs)

- Why did gold and silver prices crash so hard right after the Budget?

The crash was a “perfect storm” of domestic profit-booking following the budget, a reduction in import duties, and global factors like a stronger US dollar and new margin requirements on commodity exchanges.

- Is my Sovereign Gold Bond (SGB) still tax-free?

Only if you were the original subscriber who bought it during the RBI’s initial offer and you hold it until the full maturity period (usually 8 years). If you bought it from the stock market, you will now have to pay capital gains tax.

- Does the import duty cut make jewelry cheaper?

Yes, theoretically. A 1% cut in customs duty reduces the base cost of the metal. However, the final price of jewelry still depends heavily on “making charges” and the current international market rates.

- What is the difference between 24K, 22K, and 18K gold rates today?

24K is the purest form (99.9%) and is currently around ₹15,153 per gram. 22K (used for most jewelry) is approximately ₹13,890 per gram, and 18K (used for stone-studded jewelry) is around ₹11,365 per gram.

- What happened to silver prices?

Silver saw a massive rout, hitting lower circuits. Prices dropped from nearly ₹4 lakh per kg in late January to around ₹2.65 lakh to ₹3 lakh per kg post-budget due to extreme volatility and profit booking.

- Will the prices fall further?

Analysts expect prices to remain “range-bound” or volatile in the short term as the market absorbs the new tax rules and global cues. Many believe the current pullback will eventually attract fresh buyers looking for a “haven.”

What to Expect:

- Relief for Traders: Eases financial pressure on bullion importers and the jewellery industry.

- Potential for Lower Retail Prices: Could lead to reduced jewellery prices if global prices remain stable or fall further.

New Delhi: Gold and silver prices have risen again today. Meanwhile, the government has provided significant relief on gold and silver imports. The government has reduced the base import price used to calculate customs duty on the import of these precious metals. The Indian government has reduced the base import prices for gold and silver, a move that effectively lowers the customs duty burden on these precious metals. Govt cuts the base import price of gold and silver – What does this mean?

Govt cuts the base import price of gold and silver: The Indian government has revised the base import price of gold and silver, reducing the rate by $42 per 10 grams for gold and $107 per kilogram for silver. The move aims to support domestic trade and moderate prices amid fluctuating global metal rates.

Tariff value or the base import price serves as the benchmark for calculating customs duty and import taxes. By lowering the base price, the government effectively reduces the tax burden on importers, which may also help in stabilising domestic market prices.

This is expected to benefit jewellers, traders, and consumers who have been facing high costs due to global price volatility and currency fluctuations. Such revisions are periodically announced by the Central Board of Indirect Taxes and Customs (CBIC) to align domestic pricing with international trends.

The revised import prices may influence domestic gold and silver rates, potentially easing some cost pressures for traders and consumers. Jewellers and bullion traders are expected to adjust prices based on the new tariff value, which serves as the reference point for taxation.

The move also ensures that domestic markets remain competitive and better aligned with global commodity rates, particularly amid ongoing fluctuations in international gold and silver prices. The government’s adjustment of base import prices is part of ongoing measures to support domestic trade. Importers and buyers are advised to note the revised tariff values for future transactions.

Gold climbs Rs 2,200 to Rs 1,25,600/10g in Delhi markets

Gold prices climbed by Rs 2,200 to Rs 1,25,600 per 10 grams in the national capital on Friday, October 31, on fresh buying by stockists and jewellers, according to the All India Sarafa Association.

The precious metal of 99.9 per cent purity had closed at Rs 1,23,400 per 10 grams on Thursday, October 30.

In the local bullion market, gold of 99.5 per cent purity jumped by Rs 2,200 to Rs 1,25,000 per 10 grams (inclusive of all taxes) from the previous close of Rs 1,22,800 per 10 grams.

“Gold advanced on the last trading day of the week, buoyed by depreciation in the rupee,” Saumil Gandhi, Senior Analyst – Commodities at HDFC Securities, said. (With inputs from PTI) The Indian government has reduced the base import prices of gold and silver, lowering the reference rates used to calculate customs duties. This step makes importing the precious metals cheaper despite elevated global prices. The move is expected to provide relief to jewellers, traders and manufacturers, while also helping stabilise domestic supply and prices. Lower import benchmarks could support demand ahead of key buying seasons and improve trade dynamics. The decision reflects the government’s effort to balance revenue considerations with market stability in the precious metals sector.

Revised Gold Prices: The base import price for gold was reduced by approximately $50, bringing it down to $1,518 per 10 grams.

Revised Silver Prices: The base price for silver saw a significant reduction of over $800, lowering it to $2,657 per kilogram.

Purpose of Revision: These “tariff values” are used as the benchmark for calculating taxes. By lowering the base price, the government reduces the actual tax paid by importers, even if the duty percentage remains unchanged.

Impact on Domestic Prices: While global prices may still be rising, this policy move is intended to help stabilize domestic retail rates and ease cost pressures for jewellers and manufacturers.

Exclusions: The revised prices apply primarily to high-purity bars and coins and do not cover finished jewellery or articles imported through courier or baggage channels.

This adjustment aims to provide relief to the domestic bullion market despite rising global prices. The Indian government has reduced the base import prices of gold and silver, lowering the reference rates used to calculate customs duties. This step makes importing the precious metals cheaper despite elevated global prices. The move is expected to provide relief to jewellers, traders and manufacturers, while also helping stabilise domestic supply and prices. Lower import benchmarks could support demand ahead of key buying seasons and improve trade dynamics. The decision reflects the government’s effort to balance revenue considerations with market stability in the precious metals sector.